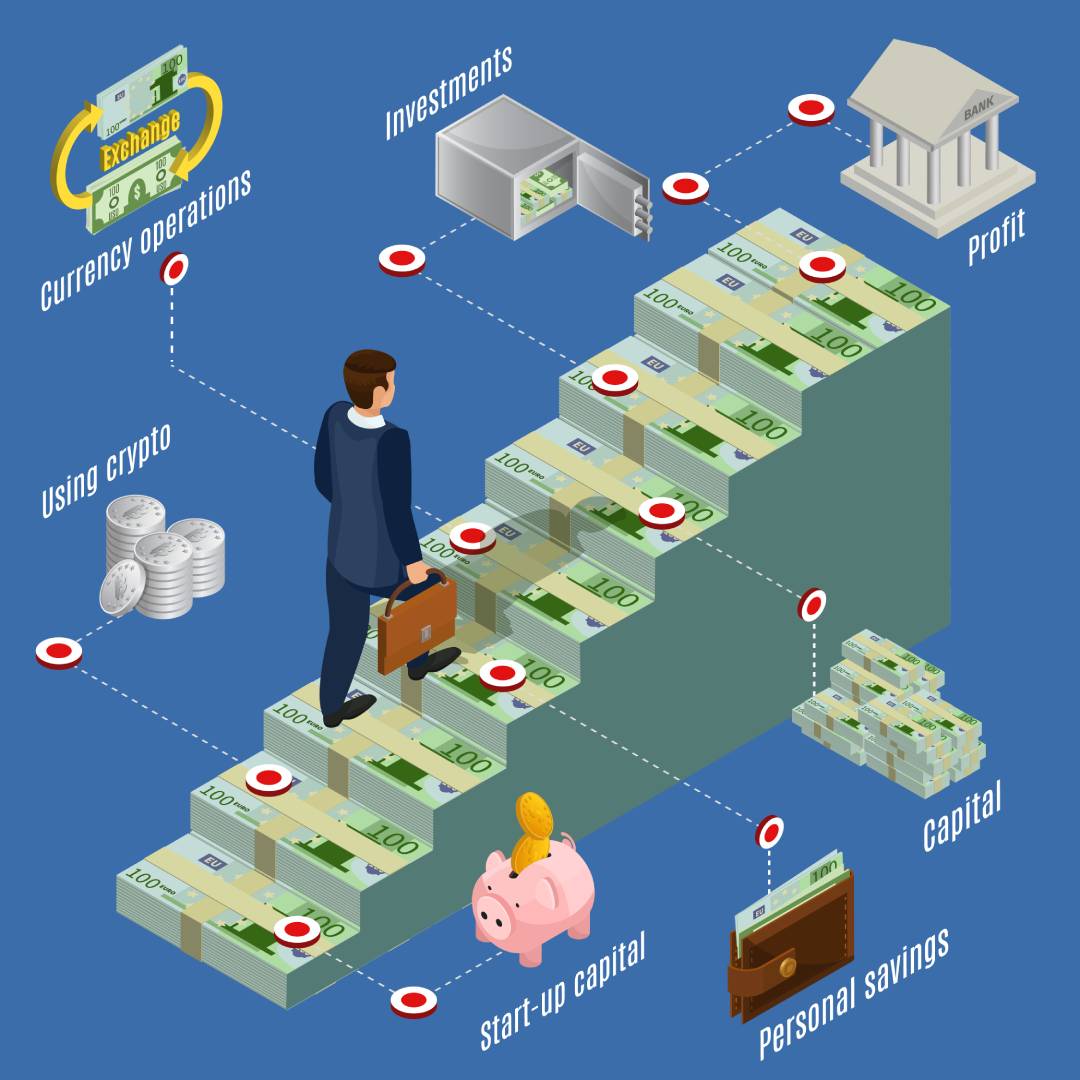

Our amenable & accountable Investment Policy sets out how we will incorporate responsible investing principles and practices into our investment decisions. This includes decisions to invest in securities, forex, Crypto and decisions to appoint investment managers.

We do our research

We make use of MSCI ESG Research and ISS ESG Research who provide us with in-depth research, ratings and analysis of the impact on the environment, social issues (like work conditions for our assets) and governance-related business practices of thousands of companies worldwide. Their research provides us with critical insights that help us identify ESG risks and opportunities that traditional investment research may overlook.

Powering Better Portfolios through Technology and Data Science

Investment professionals around the world are accelerating advances in technology and data science to generate alpha, serve clients and expand the frontiers of innovative investing. solutions help investors harness and leverage new technology and data to build better portfolios for a better world. That includes collecting and processing enormous datasets that span investment disciplines, as well as marrying quantitative analysis, research and modeling with technology that helps investors make more informed decisions, navigate a rapidly changing landscape and bring new ideas to market.